In September, Apple unveiled Apple Pay, an NFC payment system that lets you “tap to pay” at certain checkout counters.

Android has had the same feature for over a year and has long supported NFC chips.

Since the world’s two largest mobile operating systems both support NFC mobile payments, you’d think America’s biggest banks and retailers would jump on board, right?

Wrong! Apple Pay debuted earlier this week, but select retailers have already started banning NFC payment systems at their stores.

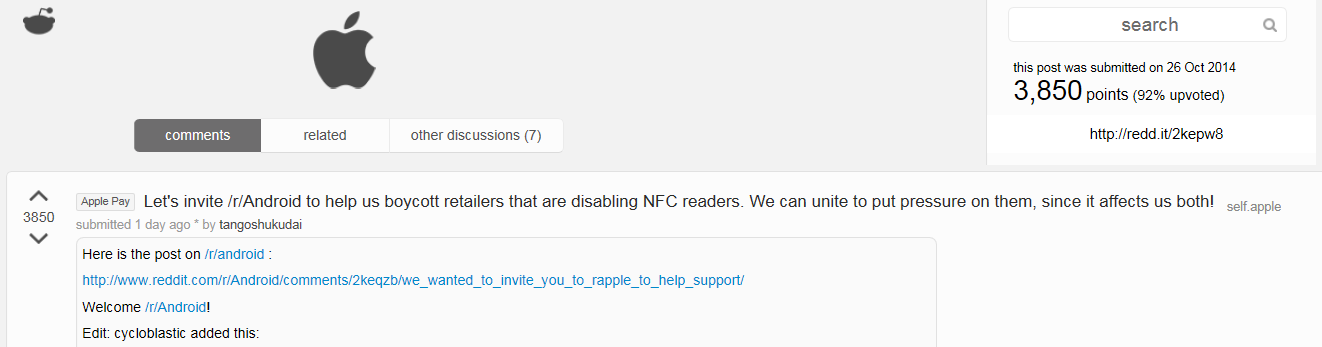

And that’s made a lot of tech fans mad. For the first time in human history, the users of Reddit’s r/Apple and r/Android have joined together to boycott a lot of retailers.

Here’s what you need to know about the boycott:

Why don’t retailers like NFC payment systems?

A number of major American retailers are part of something called the Merchant Customer Exchange. The Merchant Customer Exchange, or MCX, is a consortium of retailers that was formed in order “to develop a merchant-owned mobile payment system, which will be called ‘CurrentC’.”

CurrentC has been in active development since 2011. Retailers wanted to create an alternative payment system that helped them avoid the 2% to 3% fees charged by Visa and MasterCard, among other credit card companies.

Ultimately, retailers wanted to create a payment system they could control and profit from. Instead of losing 2% to 3% of retail sales every year, retailers could recapture that money.

If you get past all the marketing lingo, CurrentC is a payment system for merchants by merchants.

Which retailers are we talking about?

MCX is collectively owned by retailers with over $1 trillion in annual sales. Major merchants include 7-Eleven, Best Buy, CVS, Lowe’s, Michaels, Sears, Shell, Target, and Wal-Mart.

Other smaller merchants that you may use include Dick’s Sporting Goods, RiteAid, Chili’s, Bed Bath & Beyond, Gap, Olive Garden, Southwest Airlines, Wendy’s, and K-Mart.

So yeah, there are some big retailers involved in this battle. You can view a full list of common retailers in this thread.

What is CurrentC?

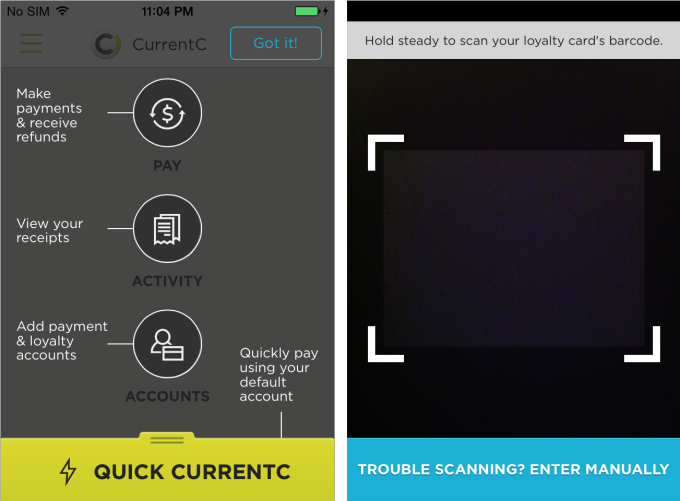

CurrentC was designed to be a competitor to platforms like Google Wallet and Apple Pay. It’s a free downloadable app that lets customers pay for merchandise at participating retailers.

Basically, you download an app and enter your debit card information into that app.

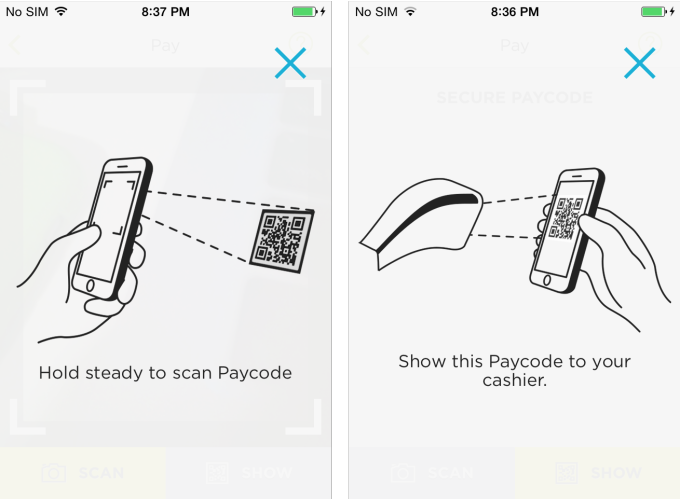

Every time you want to buy something, you scan a QR code with the app, show that QR code to the cashier, and pay for your purchase.

Why is CurrentC bad?

CurrentC is a very controversial payment system that many security experts argue is far less secure than Apple Pay or Google Wallet. Here are some of the major issues being raised with CurrentC:

-Security: You download a free app, enter your payment information into your phone, and scan a QR code on a terminal to pay for any purchase. If someone takes your phone, they can pay for stuff in your name. Your checking account info is also stored on the phone. Oh, and did I mention that TJ Maxx, Target, and Home Depot are all part of MCX – all of those retailers experienced major data leaks over the last few years. Many people don’t want to bring their personal financial data anywhere near those merchants.

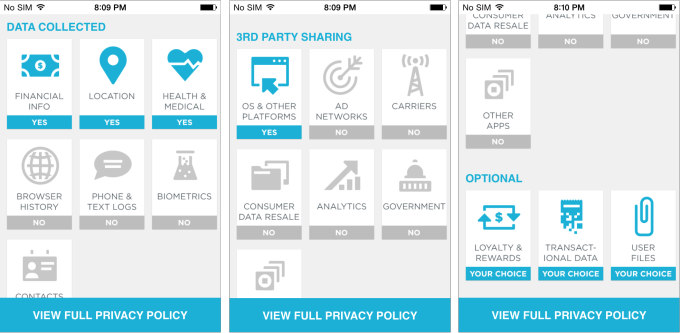

-You need to enter your SSN and other personal information: CurrentC is weirdly invasive. The setup process asks for your Social Security Number and driver’s license number, among other personal information. Don’t believe me? Read the CurrentC user privacy policy. Google Wallet, and Apple Pay on the other hand, can be setup with straightforward online setup processes that are more similar to PayPal.

-Promotions and advertisements: If you thought Google Wallet sounded bad for promotional content, then CurrentC sounds even worse. CurrentC promises to shove promotional content and coupons to users. So if CurrentC sees that you purchased a new bath mat from Wal-Mart, it might suggest you buy a new shower curtain from Lowe’s. Expect to be bombarded with loyalty program information and coupons you’ll probably never use.

-Inconvenient and annoying: Apple Pay and Google Wallet let you tap a terminal then enter a PIN to pay for a purchase. CurrentC, on the other hand, requires you to download an app, enter your banking information, carefully line up your camera with a terminal, scan a QR code, show another QR code to the cashier, and then pay for your purchase. It’s an awkward and clunky system.

-Tracks your health info: One of the scariest things about CurrentC is that it happily tracks your health info and purchase history. So if you’ve been eating lots of junk food from 7-Eleven, then you might suddenly get coupons for blood pressure pills from Wal-Mart. What happens if (or, more likely when) this health information ends up in the hard drives of Russian hackers?

-Customers will assume liability for any fraud: One of the advantages of using VISA is that customers are not liable for fraudulent purchases. If someone robs you at gunpoint, steals your wallet, and maxes out your credit cards on a spending spree, then you’re not liable for those purchases.

-Anticompetitive and unethical: Some have even gone as far as to say that CurrentC is a competitor-blocking system that is “entirely unethical”. Most people would agree that having an alternative payment system is good, but totally blocking out competing payment systems to promote that payment system? That’s bad.

Why is CurrentC good?

If you believe everything you read on r/Android and r/Apple, you’d think CurrentC was developed by Satan himself. But CurrentC does have some advantages.

First, and most importantly, CurrentC works with existing payment terminals at most major retailers. Apple Pay and Google Wallet require new equipment to communicate with the NFC chip. Isn’t it anti-capitalist to force retailers to buy millions of new payment terminals?

Second, CurrentC does not rely on Bluetooth or NFC, which means that just about any mobile device can use it.

Third, if you like coupons and rewards programs, then you’ll probably like CurrentC. CurrentC lets you view participating retailers in your area (using your GPS signal) and also delivers coupons based on your perceived interests and interested purchases.

Is NFC really any better?

NFC uses short-range radio frequency (RF) technology that sends small amounts of data to an electronic reader when in close range (like when you ‘tap’ a payment terminal). The reading distance is typically a few centimeters.

The retailer never gets your payment information. They just get your payment.

What should you do?

Ultimately, CurrentC will likely offer promotions like “use CurrentC and get $5 off your $200 purchase.” People are going to love those offers because people love to save money no matter how much personal information they give out.

If you really do care about competition and NFC payments, then you don’t have to boycott retailers like Wal-Mart and 7-Eleven.

Instead, boycott CurrentC. Don’t download the CurrentC app and don’t sign up for the platform. Keep using your credit card and before long, these retailers may decide to upgrade to NFC payment systems.

Some people are even boiling this down to a battle between IT departments: would you rather trust the IT departments at Apple and Google to protect your information? Or the IT departments at Wal-Mart, Target, and Dunkin Doughnuts?

Ultimately, r/Android and r/Apple are going to try voting with their wallets to get these major retailers to succumb to their NFC payment ambitions. If this campaign has any hope of being successful, however, it will need more than just the 1 million or so subscribers to two subreddits.

If you want to learn more about the boycott, here’s the Reddit thread that started it all